http://fundontology.com/fr/rule/Rules_Investment_Adviser_Act.ttl#Exempted_Ex_USC_s80b_3_b_4_C_Trust

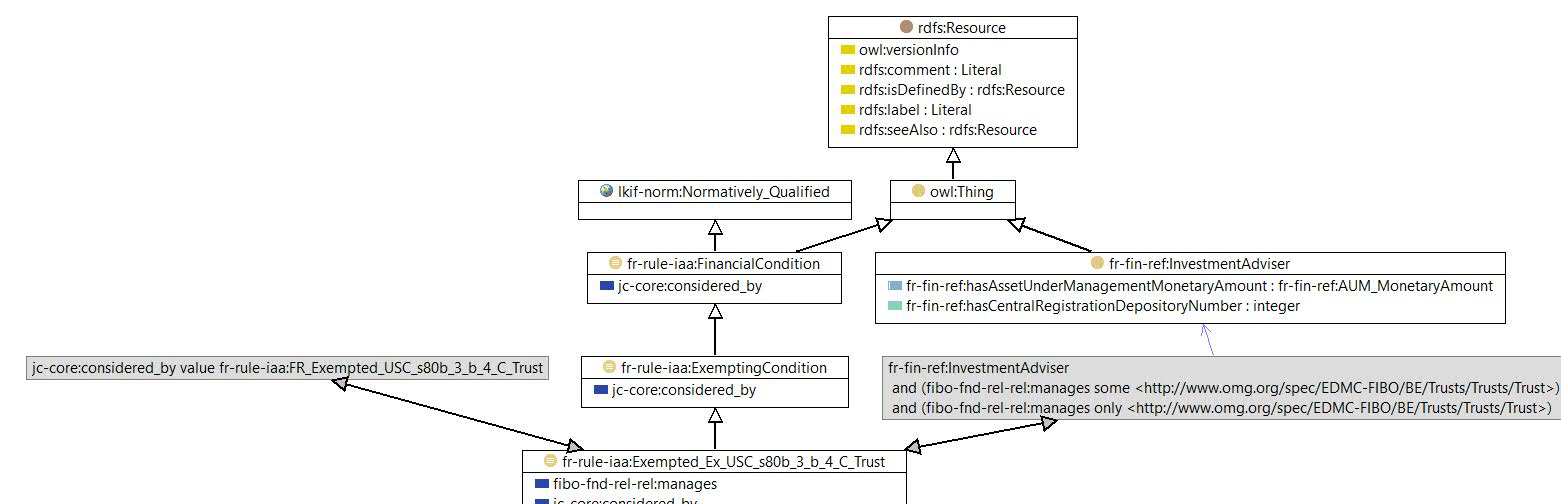

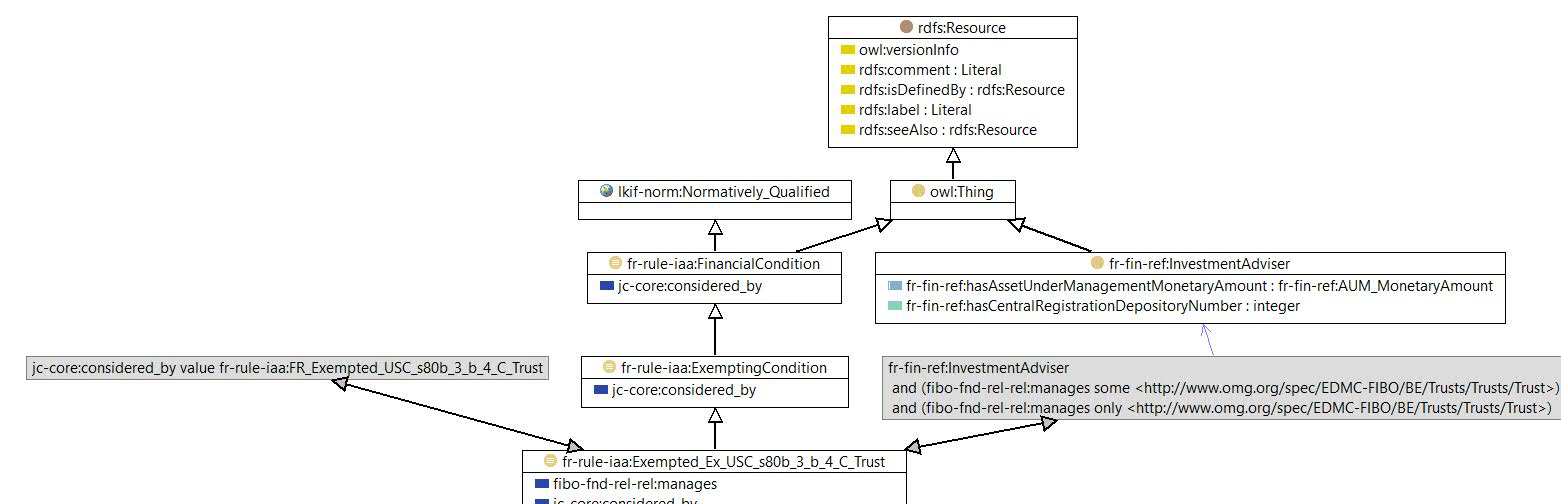

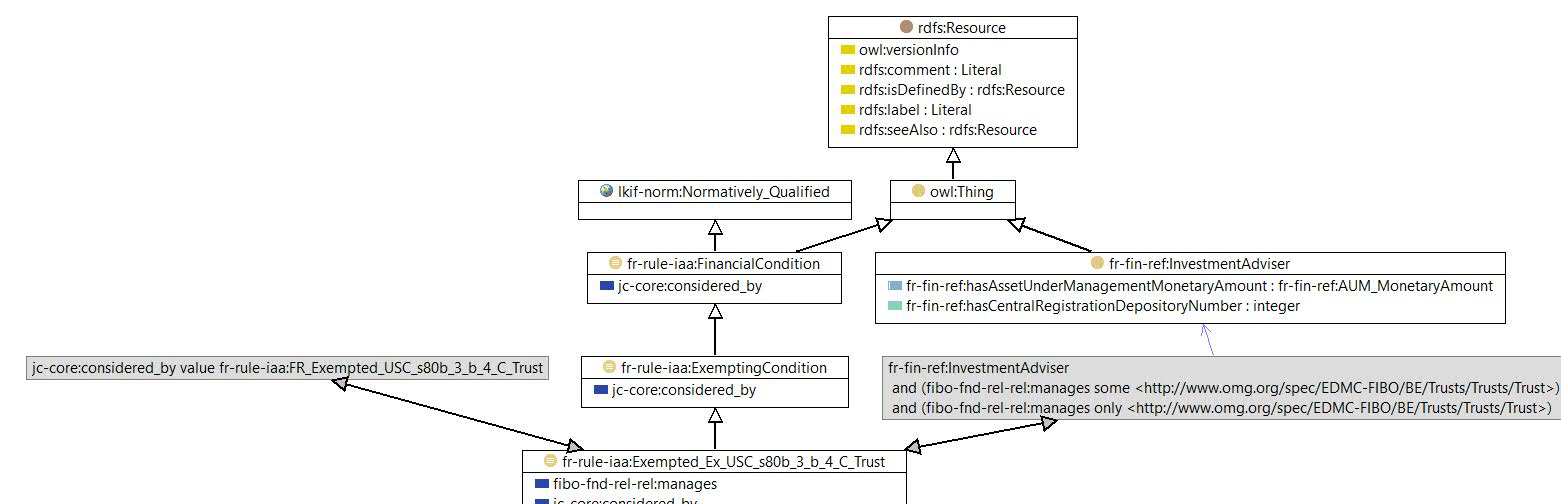

Class fr-rule-iaa:Exempted_Ex_USC_s80b_3_b_4_C_Trust

rdf:type

-

|

owl:Class |

|

rdfs:comment

-

|

This assumes that the load into FIBO assters the fund to be a Trust. As a simplification, we don't examine trustees, administrators setlers or beneficiaries.

|

|

rdfs:label

-

|

Exempted ex. USC § 80b–3 (b) (4) (C) - Trust

|

|

rdfs:subClassOf

-

|

owl:equivalentClass

-

-

|

skos:definition

-

|

An defined class for FIBO Functional Business Entities that are exempted from Securities & Exchange Commission registration under U.S. Code § 80b–3 (b) (4) : “any investment adviser that is a charitable organization, as defined in section 3(c)(10)(D) of the Investment Company Act...".

(C) a trust or other donative instrument described in section 3(c)(10)(B) of the Investment Company Act of 1940 [15 U.S.C. 80a–3 (c)(10)(B)], or the trustees, administrators, settlors (or potential settlors), or beneficiaries of any such trust or other instrument;

The equivalent class simply consits of all FIBO Investment Advisers that manage only trusts.

Inferred members are considered by the exclusion rule, which applies the exclusion status.

|

|

© 2016

Jayzed Data Models Inc. generated with TopBraid Composer

back to Fund Ontology or

documentation index